Let’s not keep you in suspense. If you're not careful, your government can confiscate your gold. Moreover, it can probably do so without compensating you. The United States, British, Australian, and many more governments have all done this within the last 100 years. So the clear answer to can the government confiscate your gold is yes. The real question is how can you avoid it?

Ironically, governments have a habit of confiscating gold just when it becomes most valuable, i.e. when fiat currencies trade down. As a real hedge against currency and economic collapse, gold can insulate you from severe economic downturns. Government purges against “gold hoarding” (the term used by the Roosevelt administration) came during financial crises in their respective countries.

While it makes much less sense for governments in steady positions to do so, you should be on guard since markets can turn fast. And when people lose faith in economies, governments are forced to pay big bucks. Is your only option to adopt the role of a fugitive? Should you risk any punishment that your government deemed acceptable for non-compliance? Or is there a better way. To begin with, we need to look at why can the government confiscate your gold.

Why Can The Government Confiscate Your Gold? How?

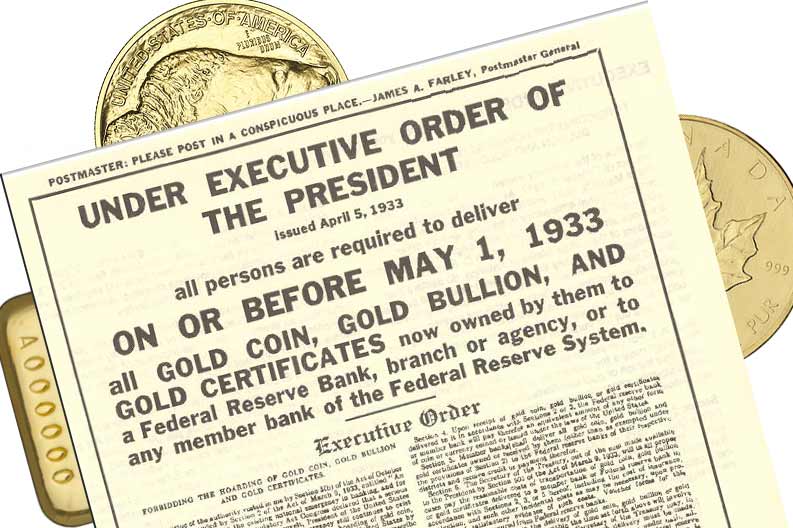

Confiscating the gold of its citizens could be one way that a central government could cope with the effects of a financial crisis. According to a New York Times archive, “The Executive Order issued by the President yesterday amplifies and particularizes his earlier warnings against hoarding.” So why is gold hoarding a problem? Well, under the Federal Reserve Act (1913), the government needed to back paper money with 40% of its value in gold. And room to issue new money was getting tight.

So here’s what they did. The Roosevelt government called anyone who owned more than roughly $100 (back then) of gold a hoarder. About a year later, they went after silver too. Sure, jewellers and others busy precious metals it in the course of professional activity were exempt. On the other hand, if you had more than roughly 5 oz of gold in coin, bullion, or certificates, you were ordered to cash them in. A bank would then exchange your gold at USD 26.67 per troy ounce. Note that the CPI-adjusted value of that cash was just under USD 400 at the time of writing.

Don’t like the act and the government will confiscate your metal anyway, and then fine you. And what justifies this? Why did the government need to increase the money supply? Many reasons, but none more relevant than to pay off debt. The Keynesian policies and New Deal couldn’t be solved so easily. While quantitative easing (QE) policies requires congressional approval, that’s easier than a gold standard requiring 40% gold-backing. Some debates on should we go back to the gold standard climax on this monetary policy requirement.

Can the Government Confiscate My Gold These Days? Or Was it All in the Past?

Within months of making gold illegal to own, Roosevelt raised the price by 40%. Gold went straight up to an official $35 per ounce. In doing so, US central funds were boosted dramatically overnight. So what really happens is that the government takes your gold, forces you to accept cash, and then makes the cash worth less gold. Although it makes less sense for a governments today to engage in these tactics today, extreme and rare circumstances still happen. it remains true that governments will go to extreme measures to negate the effects of a financial crisis, for instance. Unfortunately, such measures often just pass the burden to future generations.

For modern-day examples of how the government can invent laws to keep a firm hand on gold, look at Bitcoin. A plethora of nations have banned cryptocurrency trading. Now think about the relationship between bitcoin, gold, and similar assets. All hedge against market risks and fiat currency. If a democratic government will ban Bitcoin, then it can surely enact laws limiting precious metals given the right circumstances. Look at Germany’s repatriation of gold and you may notice preparations for a financial crisis. Countries buy gold for much the same reason individuals do. Yet, most of us don’t begin wondering about can the government confiscate your gold until it’s too late.

Can You Mitigate The Risk That the Government Will Confiscate Your Gold?

Few major countries are backed by the gold standard in the present day. That’s good and bad news because it means governments can keep printing money. On the other hand, the more money governments print, the more valuable gold (a scarce asset) becomes.

Past and present governments also stimulate or slow down the economy by tweaking interest rates. The good is that such measures may help and don’t require highly questionable government confiscations. The bad is that if things get out of control, people will likely want to see real gold reserves before trusting the greenback. In that case, get ready for the government to try and accumulate gold as quickly and cheaply as possible.

Let’s cut to the chase. Should you worry can the government confiscate your gold tomorrow? Experts suggest that the prospect of a government doing so is unlikely in the short- and medium- term. In other words, it’s not worth losing sleep over. On the other hand, keep it in mind. To mitigate your exposure, make sure that at least a little of your hedge is hedged.

When allocating how much gold to put in your portfolio, consider storing some in historically gold-friendly countries, e.g. Switzerland. You can also vault in duty-free zones where you can transport it internationally with little or no effort. Other options include owning stock in gold miners and positively gold-correlated companies, and depending on who you’re asking, buy gold bullion and hide them well. And no, in that last respect, we don’t endorse breaking the law.