It sounds like a Hollywood thriller or a 10-episode Netflix hit: the first ever true "Black Friday" flung the U.S. into financial chaos with two schemers tried to corner the country's gold market in 1869.The Black Friday gold scandal is a story unlike anything you've read.

It begins with the two robber barons Gould and Fisk

This piece of history revolved around Jay Gould and Jim Fisk, who were president and vice president of the Erie Railroad, and they earned the reputation as two of Wall Street’s most ruthless financial gurus.

Gould in particular had proven an expert at coming up new ways to game the system, and was once dubbed the “Mephistopheles of Wall Street” for his unique ability to line his own pockets. For example, in 1858, he convinced an elderly New York billionaire to invest $60,000 in a tannery business, but after a falling-out the billionaire shot himself in the head, supposedly driven to suicide by Gould's scam to shuttle his money into something not related to tanneries.

During the Civil War, congress authorized $450 million in government-backed “greenbacks” to finance the Union march to war. Competing currencies - gold and greenbacks - have been in circulation ever since, and Wall Street created a special “Gold Room” where brokers could trade them.

Since there was only around $20 million in gold in circulation at any given time, Gould figured that a speculator with deep enough pockets could potentially buy up huge amounts of the precious metal until they had “cornered” the market. From there, they could spike the price and sell for astronomical profits. Gould’s gold scheme faced one crucial hurdle in President Ulysses S. Grant. Since the start of Grant’s tenure as chief executive, the U.S. Treasury had followed a policy of using its massive gold reserves to buy back greenbacks from the public.

So the government effectively set the value of gold: when it sold its supply, the price went down; when it didn’t, the price went up. If a speculator like Gould tried to corner the market, Grant could order the Treasury to sell off huge amounts of gold. This would drive the price through the floor. For his gold scheme to work, Gould needed President Grant to keep a tight grip on his purse strings.

Winning Over Grant

Gould got his brain whirring and harnessed his friendship with Abel Corbin, a former Washington bureaucrat who was also married to Ulysses Grant’s sister, Jennie. Corbin used his political influence to help have General Daniel Butterfield named as the U.S. sub-treasurer in New York. In exchange for providing advance notice of any government gold sales, Butterfield was given a $1.5 million stake in the ploy and a $10,000 loan.

On September 2, Grant admitted that he had changed his mind on gold and planned to order the treasury not to sell over the next month.

Jay Gould and a few other conspirators had been quietly stockpiling gold since August, but when they learned that the fix was in, they disguised their identities behind an army of brokers and proceeded to snag all the gold they could. Gould also enlisted the help of his fellow financial buccaneer Jim Fisk, who quickly dropped $7 million on gold and became one of the cabal’s leading members.

And so began the climb leading up to the Black Friday gold scandal

As the Gould-Fisk ring increased its stake, gold’s value climbed to dizzying heights. In August, a $100 gold piece had sold for around $132 in greenbacks, but only a few weeks later, the price rose as high as $141.

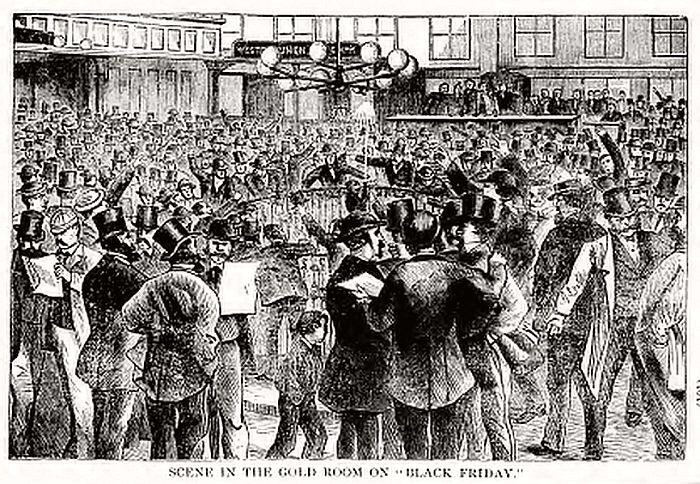

In Wall Street’s Gold Room, worried speculators and gold short-sellers suddenly found themselves in a bind. Rumours spread about a sneaky group of speculators who were trying to “bull,” or drive up, the gold market. Many began calling for the Treasury to intervene by selling its gold reserves. Fisk and Gould kept quiet. By that point, they personally owned a combined $60 million in gold (roughly $1bn in 2017 dollars). That was three times the amount of the public supply in New York.

Gould’s shopping spree continued without end until September 22. It was then that he learned from Corbin that the president was on to the plot. Corbin had written Grant a letter looking for assurance that he remained firm on his new, non-interventionist gold stance. This note finally piqued the president’s suspicions that his brother-in-law might be involved in a gold scheme.

Angry at having been manipulated, the president had his wife write a response chastising Corbin. It warned that Grant would not hesitate to “do his duty to the country” and break the corner. Gould was surprised, but he neglected to divulge the new information to Fisk or his other partners. Instead, when the buying spree resumed on September 23, he began secretly selling off as much of his own gold as he could.

And so Black Friday gold prices leaped north of USD $2,600 (inflation adjusted)

By September 24, 1869—the day that would become known as “Black Friday”—the buzz over gold had reached a fever pitch. Mobs of spectators and reporters gathered near Wall Street, and many of the Gold Room’s indebted speculators walked to work like men on their way to the gallows. Gold had closed the previous day at $144 ½. Still, soon after trading resumed, it took a stunning leap to $160. Unaware that the game might soon be up, Fisk continued buying like a man possessed. He bragged that gold would soon top $200.

Meanwhile, Grant resolved to bust Gould and Fisk’s corner on the gold market. Shortly before noon, he met with Treasury Secretary George Boutwell Boutwell had been studying the chaos via telegraph. After a brief conversation, Grant ordered Boutwell to open his vaults and flood the market. Soon after, Boutwell wired New York and announced the Treasury would sell a whopping $4 million in gold the following day.

The Black Friday Gold scandal created chaos

Along with finally loosening Gould and Fisk’s grasp on the gold market, the news sent Wall Street into chaos. “Possibly no avalanche ever swept with more terrible violence,” the New York Herald later wrote.

Within minutes, the inflated gold prices plummeted from $160 to $133. The stock market joined in on the fun, dropping a full 20 percentage points. This inflicted severe damage on some of Wall Street’s most venerable firms and bankrupted others. Thousands of speculators were left financially ruined. Foreign trade ground to a halt. Farmers may have felt the squeeze most of all, with many seeing the value of their wheat and corn harvests dip by 50 percent.

Ripples from “Black Friday” affected the U.S. economy for several years and blighted the rest of Ulysses S. Grant’s tenure as president. Still, Jay Gould and Jim Fisk managed to escape the disaster none the worse for wear.

Despite multiple allegations of malfeasance and an official investigation by Congress, the two harnessed their political connections. Employing a brigade of attorneys, they avoided spending a single night in jail.

Historian Sean Munger writes: "Today, of course, something like Black Friday could never happen, as one of the purposes of the Federal Reserve is to stabilize the money supply to prevent corners and panics."

But we've seen crazier things like the story of the Hunt Brothers and Silver Thursday ... So don't forget that black swans like Black Friday are always just around the corner.