A raging bull market and faith in American industry have created a tumultuous time for silver investors. For Americans, a stock-market boom since the beginning of the Trump administration has led to declining unemployment. Lower taxes on corporate earnings are even making the USA more competitive for business. In Canada, this is when precious metals should shine. Holding an economic hedge, Canadians should be asking why are silver prices going up?

That’s far from the case. With a stronger Canadian economy (or a weaker global one), the Canadian dollar has been gaining. All of this has led to an inconvenient truth that some silver bullion investors may have forgotten. That is; to succeed as a contrarian investor, you need to be ahead of the curve. The reason most people don’t succeed has less to do with “knowing” the answer, as it does in believing it.

The funny thing is that for Canadian investors, now may be a good time to buy. Here are two simple reasons. First a stronger Canadian dollar means a better purchase price. When you think about buying silver at spot and selling silver at spot, you realize how important that is. The lower the purchase price below an investment’s intrinsic value, the higher the margin of safety.

Are Silver Prices Going Up Anywhere?

People invest in precious metals for so many reasons. From the perspective of many of these reasons, investors are achieving their goals very well. Take, for example, capital preservation. Your goal is to avoid major hits to your portfolio. As the famous Buffet saying goes, rule number one is never lose money. Rule number two is see rule number one!

As always, there are at least two ways of looking at this point. First, the intrinsic value of your assets hasn’t changed. Just because “Mr. Market” decides that today he is going to offer you less for your assets doesn’t mean they are worth less. Why? Start with the fact you do not have to sell. Move to the fact that “Mr. Market” is schizophrenic. Then, end on the fact that when everyone is selling, it is usually a good time to buy.

The second thing is that your precious metals are a hedge against both sharp market declines and catastrophic ones. Think about that. You have an insurance policy that protects you from both the gradually destructive force of inflation, as well as geo-political catastrophes.

Where Are Silver Prices Going Up?

So, the argument goes, you can enjoy an artificially inflated economy, without worrying about what happens if and when it comes crashing down. Still, in any and every country getting into significant economic problems. Sure, if your country’s economy was never thriving, per se, you might not see it. On the other the “hot” country decides to next declare bankruptcy will see soaring gold and silver prices.

Yet the fact is that, right now, silver prices may not be where you think they should. I think that a smart investor avoids making many short-term bets. Rather, they need to think about are silver prices going up in the long term. Assuming they think so, I would ask how are silver prices going up? Although it may be hard to do on some days, zooming in and out of financial charts can be fruitful.

How Are Silver Prices Going Up Long-Term if Markets Doing Well?

Those who have spent years involved in the markets will know that day-to-day fluctuations of a stock mean little for long-term investment potential. In fact, paying too much attention to the short term will kill your returns just as fast as your health. If you really want to assess future prospects, you need to spend your time learning about everything from global economics to mining production. These factors are where investors best spend their time.

Historically, silver has outperformed gold for rather simple reasons. Industrial demand, for example, has been a record driver for silver. That is why you really need to understand the how of why are silver prices going up long-term. There are technical approaches looking to past market data such as those modelling performance over time.

A fundamental approach, on the other hand, answers how are silver prices going up in the long-term by looking at market factors such as interest rates and overall sentiments. This helps explain why natural market undulations pushing prices way down for a prolonged period before prices shoots back up can be averaged out.

As the mining output increases and decreases year-over-year, and silver gains in intrinsic strength when as markets become more volatile, patient investors build their wealth. As you come to understand the structural and specific forces affecting silver prices, you can make better decision on how to do that.

Although the future is never predictable in the silver markets, savvy investors succeed by taking contrarian positions. Whether looking at how much silver is in the world, or recent performance, they keep in mind long-term factors. For example, the cheaper you buy the better you sell and the safer you are. They are also better protected from the scourge of inflation and catastrophe alike. Historically, markets doing well mean that your investments are protecting you actively from inflation and passively from catastrophe.

Are Silver Prices Going up Tomorrow?

Our research shows that there is a lot of opportunity to make money in precious metals. Depending on when you take them, five-year readings can suggest depreciating silver stocks. Yet, recent industry movements show a turn around is in the works. Perhaps the chief indicator is the turnaround price of gold. Frank Holmes, the CEO and Chief Investor at US Global Investors, has recently come out to remind everyone that when gold reaches over USD 1,300 per ounce it usually draws people to silver.

1-year Investment Performance:

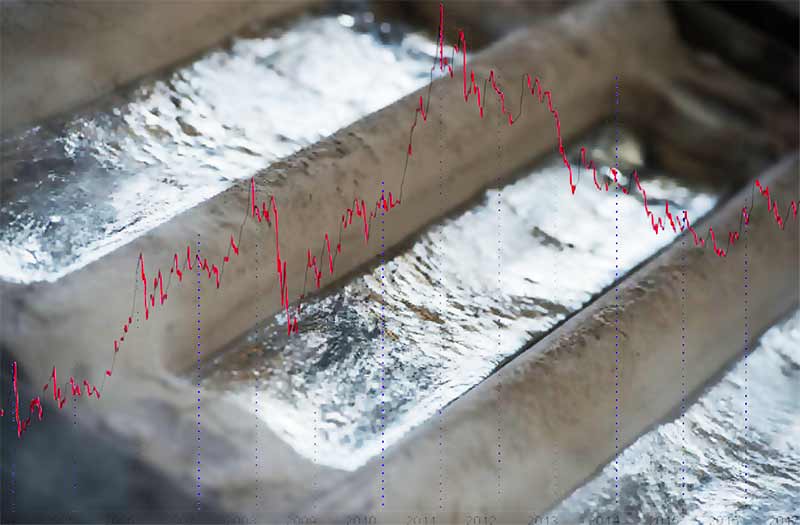

The price of silver has not been on a gradually slow build as of recently. In fact, it is quite the opposite. Silver prices spent all of 2017 in a rise and fall motion - either it was moving swiftly upwards to an eventual peak of USD 18.52, or it was falling from such heights and winding up somewhere above the yearly low of $15.56. In terms of actual volatility, silver represents a solid investment when you consider that it began the year around $17 per ounce and at the time of writing sits at $17 per ounce.

5-year Investment Performance:

The macro-view of silver prices indicates a general trends downwards. Consider these comparisons to get an idea of where silver has gone since 2013. In 2013, silver was worth over $30 per troy ounce. It began to fall at the end of 2013 and has continued a slowly trajectory downwards. Stock price peaked over twenty once since 2014. It occurred in the middle of 2016 but only lasted a short time. The lowest stock price over a five year space is $13.7 per troy ounce, which occurred in January of 2016.

But Why Are Silver Prices Going Up So Slowly?

A recurring reason for this is the accounted for increase in supply coming from silver mines across the world. Output has fallen under some hard times recently. Still, it is expected the output will might a surplus in 2018. The real question is demand, which was hit in 2016 by the Indian government's crackdown on bullion imports. This may increase long-term pent-up demand, but has presently deflated the market. Likewise, you need to think about industrial demand. A two percent growth is expected in the coming year, driven mostly by automotive and solar sector demand.

Getting a good picture of silver performance requires a wide-angle lens. Many silver traders and forecasters are predicting an improvement based on both technical and fundamental analyses. One article on silver investing in Investingnews.com discussed the various opinions shared by experts on the stock price of silver in 2018. A majority gave the assessment that silver will rise approximately $3 to end the year over $20 once again. While the only analysis to rely on is your own, in such a sentiment-driven market, consensus opinion can be valuable.